What does the financial advisor career path look like?

April 6, 2023

April 6, 2023

What does the financial advisor:- Have you ever considered a career in finance? If so, have you thought about becoming a financial advisor? As a financial advisor, you will have the opportunity to help people achieve their financial goals and secure their financial future. This career path can be both rewarding and challenging, and it requires dedication, hard work, and a passion for helping others.

In this blog, we will explore what the financial advisor career path looks like, what skills and qualifications are required, and what opportunities exist within this field. We will also delve into some of the questions that you may have about this profession, such as how to become a financial advisor, what types of clients you can work with, and what the earning potential is.

What is a financial advisor?

Before we dive into the career path of a financial advisor, let’s first define what this profession entails. A financial advisor is a professional who helps individuals and businesses manage their finances, including investments, taxes, insurance, and retirement planning. They provide advice and guidance to clients on how to make informed financial decisions and achieve their financial goals.

As a financial advisor, you may work independently or as part of a larger financial services firm. You will be responsible for building relationships with clients, understanding their financial needs and goals, and creating customized financial plans to help them achieve their objectives.

What Skills and Qualifications Are Required?

To become a financial advisor, you will need a combination of education, experience, and skills. Most financial advisors have at least a bachelor’s degree in finance, accounting, economics, or a related field. However, some employers may accept candidates with a degree in a different field if they have relevant work experience.

In addition to a formal education, financial advisors must possess a variety of skills, including:

- Communication: Financial advisors must be able to communicate complex financial concepts to clients in a clear and understandable manner.

- Analytical skills: They must be able to analyze financial data, evaluate investment opportunities, and create customized financial plans for clients.

- Sales skills: Financial advisors must be able to sell their services to potential clients and build long-term relationships with existing clients.

- Time management: They must be able to prioritize tasks, manage their time effectively, and meet deadlines.

- Ethics: Financial advisors must adhere to ethical standards and act in the best interest of their clients.

What Does the Career Path Look Like?

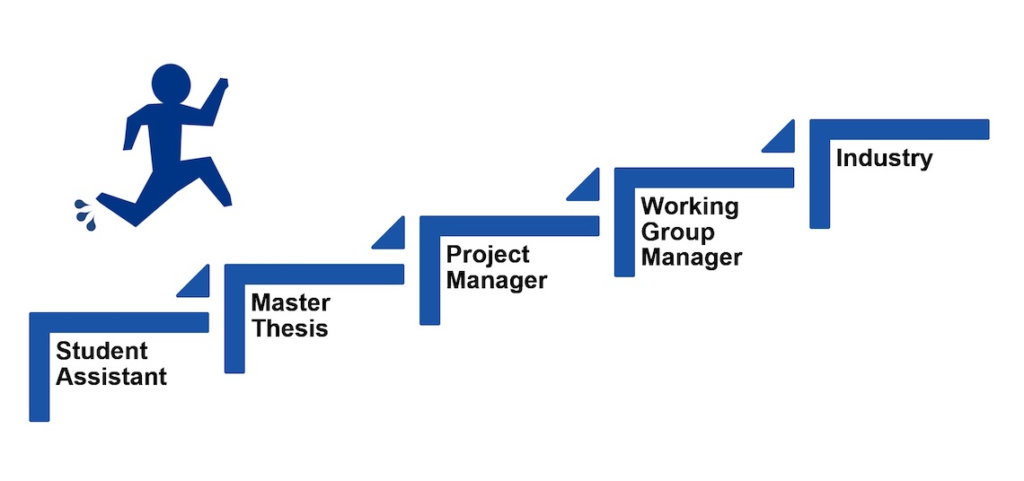

The financial advisor career path typically begins with an entry-level position, such as that of a financial analyst or a sales associate. As you gain experience and build your client base, you may be promoted to a financial advisor role.

Many financial advisors work for financial services firms such as banks, insurance companies, or investment firms. However, some may choose to work independently or start their own financial advisory firms.

As a financial advisor, you can specialize in a particular area, such as retirement planning, estate planning, or investment management. You may also work with a specific type of client, such as high net worth individuals, small business owners, or retirees.

What Opportunities Exist Within the Field?

The financial advisor field is constantly evolving, and there are many opportunities for growth and advancement. As you gain experience and build your reputation, you may have the opportunity to take on more complex and challenging projects.

Some financial advisors choose to specialize in a particular area, such as tax planning, wealth management, or risk management. Others may decide to pursue additional certifications, such as the Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) designations.

Financial advisors can also pursue leadership roles within their organizations, such as branch manager or regional director. They may also choose to start their own financial advisory firms or become consultants.

What Types of Clients Can You Work With?

Financial advisors can work with a wide range of clients, from individuals to large corporations.

Individual clients may include people who are just starting their careers and need help creating a financial plan, families looking to save for their children’s education, or retirees who need assistance managing their retirement accounts.

Financial advisors may also work with small business owners, helping them manage their finances and create retirement plans for their employees. They may also work with large corporations, offering advice on investment strategies, risk management, and employee benefits.

What does the financial advisor

Financial advisors may specialise in working with specific types of clients, such as high-net-worth individuals, athletes, or medical professionals. These specialised advisors understand the unique financial challenges and opportunities that these clients face and can provide customised solutions to meet their needs.

Regardless of the type of client, financial advisors must have strong communication skills and the ability to build relationships based on trust and mutual respect. They must be able to listen to their clients’ needs and concerns and provide customised advice that aligns with their financial goals.

What is the earning potential?

Financial advisors can earn a lucrative income, but the amount they earn depends on several factors, including their experience, education, and the size and type of their client base. Financial advisors who work independently may earn more than those who work for a larger financial services firm, as they have more control over their fees and commission structure.

According to the Bureau of Labor Statistics (BLS), the median annual wage for personal financial advisors was $89,160 in May 2020. However, top earners in this field can earn well over $200,000 per year.

Financial advisors may also earn bonuses or commissions based on the products and services they sell to their clients. However, it is important to note that financial advisors must adhere to ethical standards and act in the best interest of their clients rather than their own financial gain.

Conclusion

The career path of a financial advisor is a challenging and rewarding one, offering the opportunity to help people achieve their financial goals and secure their financial future. It requires a combination of education, experience, and skills, including strong communication, analytical, and sales skills.

Financial advisors can work with a wide range of clients, from individuals to large corporations, and can specialise in a particular area or type of client. They can also earn a lucrative income, but they must act ethically and always prioritise their clients’ best interests.

If you have a passion for finance and helping others, a career as a financial advisor may be the right path for you. With dedication and hard work, you can build a successful and fulfilling career in this field.